Iron ore, a fundamental raw material in steel production, plays a pivotal role in global economic development. Its price trends and market dynamics are crucial indicators of industrial activity and economic health. This press release delves into the current state of iron ore prices, analyzing regional trends, key industrial uses, and influential market players.

Request For Free Sample: https://www.procurementresource.com/resource-center/iron-ore-price-trends/pricerequest

Definition

Iron ore is a naturally occurring mineral, primarily composed of iron oxides such as hematite (Fe2O3) and magnetite (Fe3O4). It is the primary source of iron for the steel industry, making it a critical commodity in the global market. The extraction of iron ore involves mining and processing to produce a concentrated form suitable for use in blast furnaces and steel production. The quality of iron ore is determined by its iron content and the presence of impurities such as silica, alumina, and sulfur.

Key Details About the Iron Ore Price Trend

Global Price Trends

Iron ore prices have experienced significant fluctuations over the past decade, driven by a combination of supply and demand factors, geopolitical events, and economic conditions. In recent years, prices have been influenced by several key factors:

- Supply Disruptions: Major producers like Australia and Brazil have faced production challenges due to natural disasters, labor strikes, and regulatory changes. For instance, the Brumadinho dam disaster in Brazil in 2019 caused a significant reduction in Vale’s iron ore output, tightening global supply and pushing prices upwards.

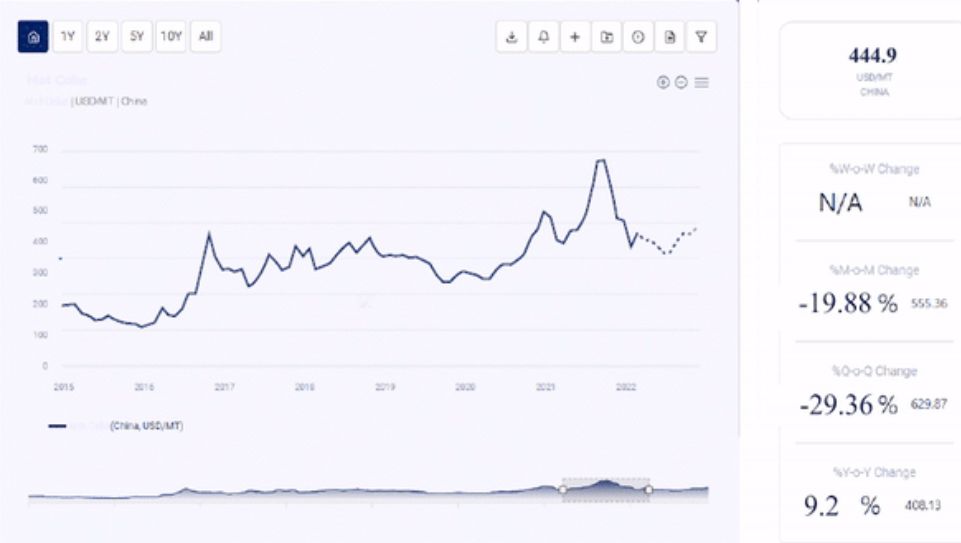

- Demand from China: China, the world’s largest consumer of iron ore, plays a dominant role in setting global prices. The country’s robust industrial activity, urbanization projects, and infrastructure investments drive high demand for steel, thus boosting iron ore prices. Any slowdown in China’s economy, such as those seen during the COVID-19 pandemic, can lead to decreased demand and falling prices.

- Economic Policies and Trade Relations: Trade tensions, tariffs, and changes in economic policies among major economies can impact iron ore prices. For example, the U.S.-China trade war introduced uncertainties in the market, affecting global trade flows and commodity prices.

- Technological Advancements: Innovations in mining and processing technologies can alter production costs and efficiencies, thereby influencing prices. Advances in automation and remote operation technologies have helped reduce costs and increase production capacities.

Regional Price Trends

Asia

In Asia, iron ore prices are heavily influenced by China’s demand. The country’s steel production capacity and infrastructure projects create a continuous need for high-grade iron ore. Prices in this region are typically high, reflecting strong demand. However, fluctuations occur based on seasonal variations in construction activity and government policies aimed at curbing pollution.

Europe

European iron ore prices are influenced by the region’s steel production and economic health. The demand for steel in automotive, construction, and manufacturing sectors drives iron ore prices. Economic slowdowns, such as those caused by the COVID-19 pandemic, can lead to reduced demand and lower prices.

North America

In North America, the iron ore market is influenced by the United States and Canada’s steel industries. The region has seen stable demand, driven by infrastructure projects and manufacturing activities. Prices in North America are also affected by trade policies and agreements, such as the United States-Mexico-Canada Agreement (USMCA).

Latin America

Latin America’s iron ore market is dominated by Brazil, one of the largest producers and exporters of iron ore. Price trends in this region are closely tied to Brazil’s production capabilities and export volumes. Environmental regulations and mining policies in Brazil significantly impact regional prices.

Middle East & Africa

The Middle East and Africa region has emerging markets with growing infrastructure needs. Iron ore prices here are influenced by industrialization projects and investments in construction. Political stability and regulatory frameworks also play a role in shaping price trends.

Industrial Uses Impacting the Iron Ore Price Trend

Iron ore’s primary use is in the production of steel, which is essential for various industries. The demand for steel, and consequently iron ore, is driven by several key sectors:

- Construction: The construction industry is the largest consumer of steel, using it for building structures, bridges, and infrastructure projects. Urbanization and development projects in emerging economies significantly boost iron ore demand.

- Automotive: The automotive industry relies on steel for manufacturing vehicles. Trends in automobile production, including shifts towards electric vehicles and lightweight materials, impact iron ore prices.

- Manufacturing: Steel is vital for manufacturing machinery, appliances, and industrial equipment. Economic cycles and manufacturing activities influence iron ore demand.

- Infrastructure: Government investments in infrastructure, such as railways, roads, and airports, drive demand for steel and iron ore. Infrastructure development in developing countries contributes to long-term demand growth.

- Energy Sector: The energy sector uses steel for constructing pipelines, power plants, and renewable energy infrastructure. The transition to renewable energy sources and investments in energy projects affect iron ore demand.

Key Players

The global iron ore market is dominated by a few major players, who influence production, pricing, and supply dynamics. Some of the key players include:

- Vale S.A.: As one of the largest iron ore producers, Vale’s operations in Brazil and other regions significantly impact global supply. The company is known for its high-quality iron ore and extensive mining operations.

- Rio Tinto: A major player in the global iron ore market, Rio Tinto operates large-scale mining projects in Australia. The company’s efficient mining practices and investment in technology contribute to its market dominance.

- BHP Billiton: BHP is another leading producer with significant iron ore operations in Australia. The company’s focus on sustainable mining practices and cost efficiencies bolsters its competitive position.

- Fortescue Metals Group: Fortescue, based in Australia, is known for its substantial iron ore production and innovative mining techniques. The company’s strategic investments and expansion plans enhance its market influence.

- Anglo American: With operations in South Africa and Brazil, Anglo American is a key player in the iron ore market. The company’s diversified portfolio and focus on sustainability initiatives drive its market presence.

Conclusion

Iron ore remains a critical commodity in the global market, with its price trends and market dynamics reflecting broader economic conditions. Understanding the factors influencing iron ore prices, from supply disruptions and demand from key regions to industrial uses and the role of major players, is essential for stakeholders in the steel and mining industries.

Procurement Resource provides comprehensive insights and analysis on iron ore prices, trends, and forecasts, helping businesses navigate the complexities of the market. By staying informed about the latest developments in the iron ore industry, companies can make strategic decisions to optimize their procurement processes and ensure sustainable growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Christeen Johnson

Email: [email protected]

Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA